- Simply click to talk about on the Texting (Reveals when you look at the the fresh windows)

- Mouse click to duplicate hook up (Opens from inside the brand new screen)

S. Attorney’s Work environment, District of brand new Jersey centered on a statement from the U.S. Department of Justice (DOJ) and you can You.S. Attorney Philip Sellinger.

Gallo in the past common views having HousingWire into the his business strategy to have 2023 shortly after long lasting demands when you look at the 2022. At that time, Gallo try employed by Nj-new jersey Lenders Corp, which mostly works when you look at the Nj, New york and you can Pennsylvania.

Near to Gallo, Mehmet Elmas was also titled throughout the issue, registered from the a unique agent doing work in Work environment of your own Inspector Standard (OIG) in the Government Property Money Company (FHFA). The fresh ailment claims that Gallo and Elmas were employed by the newest exact same business during the time of the newest alleged offense, with Elmas working as Gallo’s secretary.

Gallo and you can Elmas has actually for each and every surfaced on the a good $200,000 thread immediately following lookin prior to a magistrate court when you look at the Newark federal courtroom, the brand new DOJ said.

Christopher Gallo has been recognized as a high-creating mortgage originator, from the one-point being named Scotsman Guides fourth-rated LO in america

Off 2018 as a result of , Gallo and you may Elmas utilized its ranks so you can conspire and you can do a fraudulent system in order to falsify financing origination documents delivered to mortgage loan providers for the Nj-new jersey and you may someplace else, plus its former company, to help you fraudulently get mortgage loans, this new DOJ alleges.

The pair presumably regularly misguide lenders regarding intended the means to access functions so you’re able to fraudulently secure straight down financial interest levels, incorporating it often registered loan applications wrongly proclaiming that the brand new detailed individuals have been the key owners of certain proprieties whenever, indeed, men and women characteristics have been intended to be utilized once the local rental otherwise resource properties, the latest criticism alleges.

New so-called scheme fooled loan providers concerning the true implied utilization of the properties, and Gallo and Elmas protected and you will profited off mortgages that were accepted on all the way down rates of interest, the newest DOJ advertised.

The brand new so-called conspiracy and provided falsifying assets details, also strengthening coverage and you can economic recommendations off possible consumers in order to assists financial mortgage recognition, the DOJ so-called.

Nj Lenders was proud of their 33 numerous years of properly assisting property owners that have stability and you will reliability. Our company is totally working together with the authorities in addition to constant study out of one or two previous teams, told you Mark Tabakin, legal counsel to possess Nj-new jersey Loan providers.

The actions ones previous professionals appear to have been matched up to profit all of them economically when you’re taking advantage of the character and you will trust of one’s firm, the guy went on. Nj-new jersey Lenders’ really works is going to continue continuous once we provide the highest number of services to our customers.

Their page in the CCM are taken down towards the Wednesday, and you may a spokesperson into Cleveland-mainly based shopping financial don’t instantaneously go back a request for remark

Gallo began over $1.4 mil inside the loans anywhere between 2018 and you will , according to the DOJ. When detailed because the fourth greatest-generating LO for the 2022 because of the Scotsman Guide, the ebook place his overall regularity from the $step 1.175 million regarding seasons by yourself. One-3rd out of his money were orders, towards relax being refinances.

Brand new conspiracy to going financial scam costs offers a max prospective penalty away from three decades inside the prison and you may a $1 million great, or twice the fresh new disgusting obtain or losings on offense, any try most readily useful, DOJ told you.

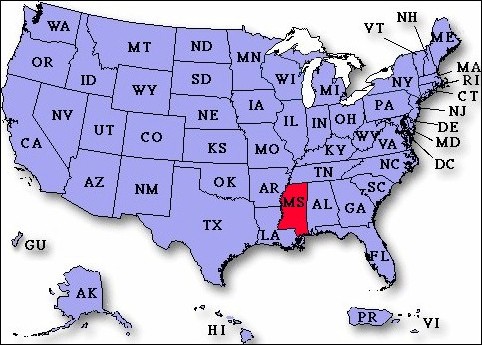

Federal prosecutors are suing Bank regarding The united states getting promoting fraudulent fund to help you Federal national mortgage association (Federal national mortgage association) and you will Freddie Mac computer (Federal Financial Mortgage Firm), a couple bodies-sponsored home loan boat loan companies. The us government alleged that the Charlotte, Vermont-dependent international ended up selling more than $step 1 mil within the crappy mortgage loans you to contributed to multiple foreclosures.